Ethereum’s Gas Race: Uniswap Guzzles & a Subway-Themed Bot Cashes In

Ethereum, the world’s second-largest cryptocurrency by market capitalization, has been foundation to a significant number of Gas Guzzling Protocols.

Picture Ethereum as a bustling metropolis and "gas" as its toll fare. Want to perform an action? Pay the gas fee. This can be as simple as transferring Ethereum or as intricate as Developing with a smart contract.

Ethereum’s Biggest Gas Guzzler: Uniswap

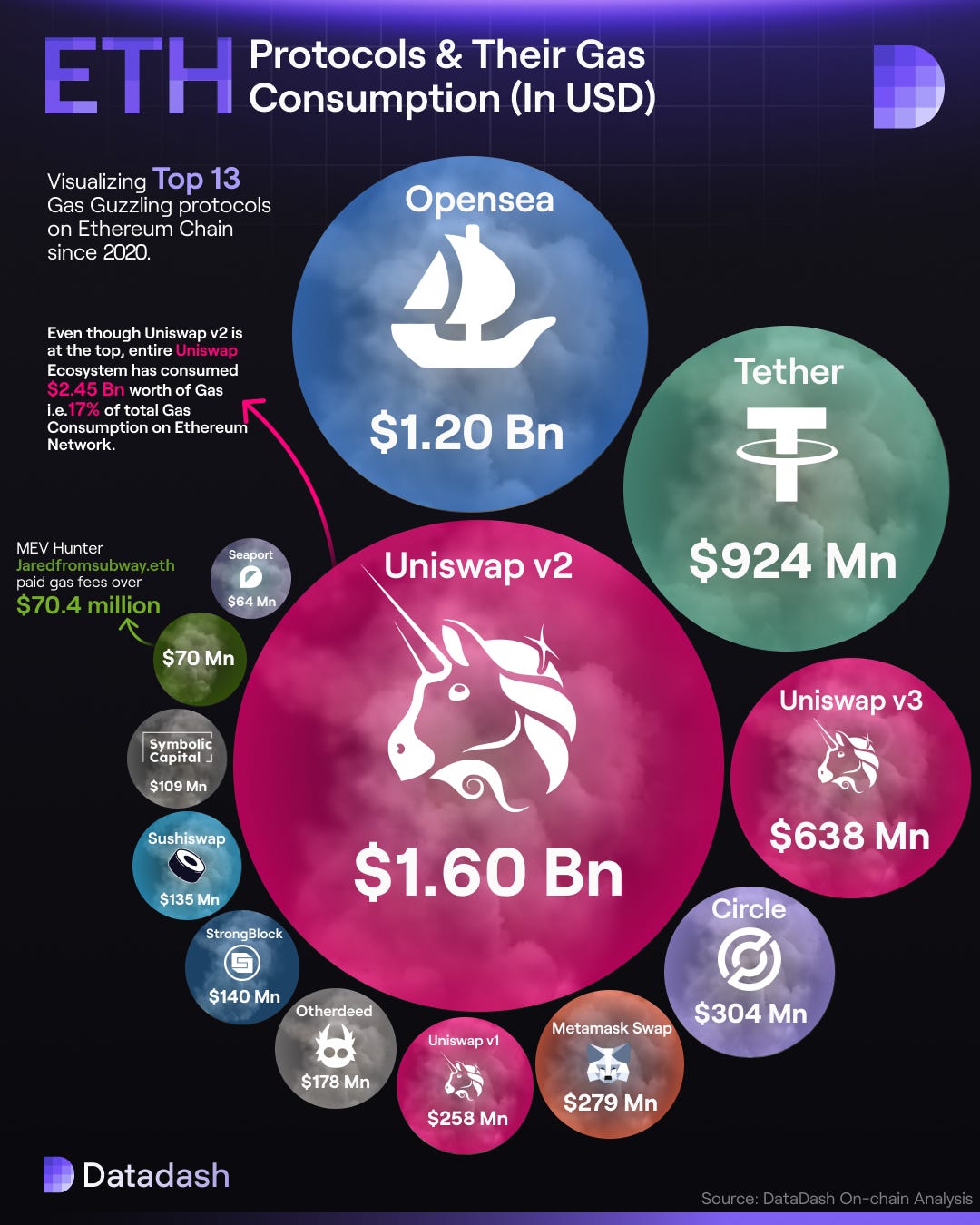

Uniswap's appetite for gas is insatiable, chugging down a whopping $2.45 billion in gas fees – that's 17% of Ethereum's total, According to Datadash. Uniswap has became the crypto hotbed, leading the pack in ETH fees and spotlighting a pivot towards success of other decentralized finance platforms.

Ever felt a sting in your pocket for quicker crypto transactions? You're not alone. Believe it or not, it is not uncommon for crypto traders to pay a crazy amount of money to speed up crypto transactions. Especially, this one crypto trader has become the top spender of gas fees on the Ethereum blockchain, USING SANDWICHES!!

Ethereum’s Biggest Gas Spender: Enter Jaredfromsubway.eth

Jaredfromsubway.eth, this cheeky, anonymous trader boasts a bill of over $70 million in gas fees over half a year. His claim to fame? Running the "most advanced MEV bot" around. For the uninitiated, an MEV bot is like a hawk-eyed day trader, but digital. It spots profitable trades on the blockchain, pounces, and usually beats humans to the punch. And this Subway fan? He mastered the art, jaredfromsubway.eth owns such a bot!!

The 'Subway Sandwich' Strategy

Here's the juicy bit: Jaredfromsubway.eth’s MEV bot is a maestro of the “sandwich attack.” Think of it as a pickpocket move in the digital realm. The bot sneakily places two trades around an unsuspecting user's transaction. It’s a quick one-two, front and back, making the user's deal the meat in a "sandwich." Sly, right?

For the curious, Jared's wallet currently jingles with 104 ETH, or roughly $166,370, at the time of writing.

Parting Thoughts

Ethereum's skyrocketing gas fees are no accident. Ethereum's popularity and the decentralized applications (dApps) built on its blockchain have led to high congestion, causing gas fees to spike significantly.

In the world of Ethereum, it's a gas race – some guzzle, some game, but all pay the price.

Thanks for reading us today. We’re always looking for stories, so if you have any suggestions on what we should cover (or comments about Crypto), comment below. If somebody forwarded this to you and you’d like to subscribe, hit the button below.